The government recently reported two consecutive quarterly declines in the nation’s GDP. But it’s not a recession.

Meanwhile the Federal Reserve Board is raising interest rates every month. You can see this here. And the word is that the Fed will raise interest rates again at the end of August. Which means that the Fed doesn’t think we are deep in a recession. Or not deep enough.

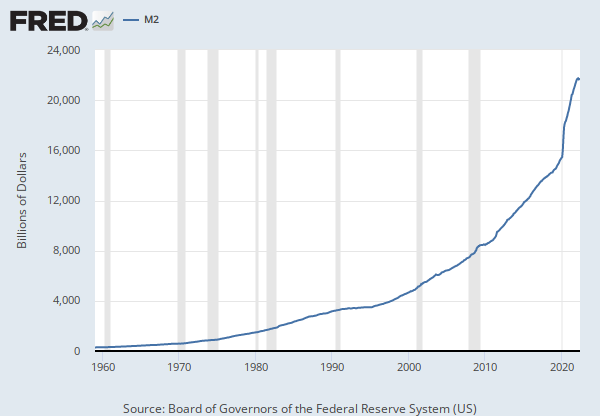

On the other hand, the nation’s money supply, M2, has been steady ever since January. See here. Now, I would have thought that if the Fed holds M2 steady at about $21 trillion, then inflation will inevitably come down. In fact, it is bound to provoke a recession. And yet it seems we are already in a recession.

If you look at the US Treasury’s Yield Curve on US Government Debt, you will see that it is beginning to show an “inverted yield curve” where longer term securities have a lower interest rate than shorter term securities. Experts agree that an inverted yield curve signals a recession. You think?

And if the Fed boosts interest rates by another 0.7 percent, then short term rates will be about the same as one-year Treasuries.

So what does the Fed know that I don’t know? If indeed it does know what it is doing.

I mean, Biden admininstration folk were talking about inflation being “transitory” over a year ago. When M2 increased from $19.4 trillion on Feb 1, 2021 to $21.7 trillion on Dec 20, 2021. That’s an increase of nearly 12 percent in 11 months. Don’t tell anyone, but I think that amounts to setting a bonfire under inflation. On the other hand, M2 has been flat since December 2021. At the end of June 2022 M2 was $21.7 trillion. Here’s the graphic from FRED. That tiny horizontal tic on the right is the money supply thus far in 2022.

You can see what I am thinking. Do any of these people have a clue what they are doing, other than nodding wisely at the results of their macroeconomic computer model, and voting for another trillion dollar spending bill?

Obviously it matters to you and me. Because if our wise rulers pitch the economy into the toilet then the folk that suffer will be you and me.

And that says nothing about the homeless who are already suffering from the various economic lurches of the last 15 years. Yes, there were tons of homeless after the 1929 crash: Skid Row bums living in Hoovervilles. All the fault of President Hoover. There were lots of homeless in the 1980s after the inflation of the 1970s ended in nasty stagflation; lots of homeless in the aftermath of the Great Recession of 2008-09. And who knows how many uprooted by the COVID years.

And our rulers are focusing on expensive green energy with the Inflation Reduction Act. Do they have any idea what they are doing?