Two hundred years ago a Col. Sibthorp came out against the railway train, the “Steam Humbug,” he called it. And the Duke of Wellington agreed. He said that railways would encourage the poor to move about. Fortunately the dear old Duke didn’t live to see the poor “moving about,” first in steamships, then in automobiles, and then jumbo jets. The idea!

But I want to talk about something that really is a problem: the Mortgage Humbug.

What I mean is that gubmint-subsidized fixed-rate 30-year mortgages has made housing unaffordable for the Average Joe.

Why? Because the low-down fixed rate mortgage encourages the poor to buy houses needlessly. So now, after half a century of low-down fixed rate 30-year mortgages, the poor can’t afford it.

Put it this way. Back in the 1920s the eevil Republicans allowed people to buy stock on margin, with 10-percent down. Anyone in FDR’s Brains Trust could have told you that was a stupid idea, because once the stock market dipped, as it did in 1929, then people we forced to sell their stocks, precipitating a Great Depression, and the result was five glorious Democratic presidential terms in a row.

So maybe not such a bad idea for the Brains Trust.

Anyway, after FDR won the 1932 election he got Congress to pass a law creating a Securities Exchange Commission and limiting stock purchases on margin to 50 percent of the purchase price so that 1929 could Never Happen Again..

But, in the 1920s, if you wanted to buy a house on margin you had to put about 50 percent down, and the mortgage was only good for 10 years. Then you had to refinance and the then going interest rate.

The Brains Trust knew, in their heart of hearts, that this mortgage policy of greedy bankers was insupportable. So the Congress passed a law creating the Federal National Mortgage Association, known to all as Fannie Mae. Its game was to buy fixed-rate mortgages and issue federal government bonds backed by the mortgages for pension funds to buy. Safe as Fort Knox.

The result, of course, was that everybody bet the farm on their home mortgage, and in the 2000s, because racism, the federal government allowed no-down loans to help traditionally marginalized people buy homes.

Oh dear! In the 2008 crash when home prices dropped, many of the bonds issued by Fannie got downgraded, and that meant that your average pension fund couldn’t buy them. No worries, good guys like Bear Stearns made the bonds triple-A again by using derivatives. That worked well until Bear Stearns failed in March 2008 and then Lehman Brothers failed in September 2008.

Oh by the way, Fannie Mae and Freddie Mac, the Federal Home Loan Mortgage Corporation, collapsed in early September 2008 and were taken over by the Federal government.

Everybody knows that the Federal Reserve System, as the “lender of last resort” should have bailed out Lehman Brothers, but Little Ben Bernanke, Chairman of the Federal Reserve said that he didn’t have the authority. So we had the financial crisis of the ages, lots of minority borrowers lost their houses, and all the good people blamed “greedy bankers.”

In the aftermath of 2008, the Federal Reserve implemented a Zero Interest Rate Policy that kept interest rates low, right up until it had to start fighting inflation in 2022 after the money printer go brrrr of 2020. As I posted on Twitter at the end of 2022, between 2009 and 2022:

Nominal GDP up 77.5%

Real GDP up 31%

S&P up 300%

NASDAQ up 714%

Personal Income up 79%

Consumer Prices up 41%

Home Prices up 100%

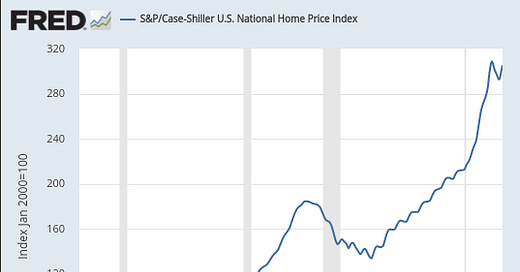

So, if you were a wage-earner at least your wages were up a bit in real terms. If you were a home-owner you got a good fillip to your home value. But if you had SPY and QQQ in your IRA or 401k, hey baby! Here’s the S&P/Case-Schiller Home Price Index from FRED:

Notice how home prices were on an exponential track in the 1990s and 2000s, and shot up after the money printer go brrrr in 2020? All I can say is that when you muck around with house prices like that, because money printer go brrrr, ordinary people get screwed.

I talked to a French woman recently and she reported that the same mortgage rules apply in France: low down and fixed rate mortgages.

Of course, we know why the gubmint has its low-down fixed-rate mortgage scam. It’s because “the poor” get screwed if you require 50 percent down. How’s a poor wage earner going to save a 50 percent down payment? The injustice!

All I can say is to retail the story of my Greek friend, that his father, who came to the US soon after World War II, and worked as a dishwasher and cook in Portland, Oregon, was able to buy a house in Portland — actually it was in the business district, with a barber shop and a restaurant on the ground floor and an apartment on the first floor — in the mid 50s. I’ll bet you a nickel that a restaurant cook couldn’t buy a house in Portland today.

In other words, our capable and educated ruling class has Made Things Worse on the housing affordability front.

Just as they have Made Things Worse on the inflation front.

Just as they have Made Things Worse on the race relations front.

Just as they have Made Things Worse on the education front.

It could be that it is Time For a Change. But who knows?

Back to your regularly scheduled program.

Chritopher, forgive me where I’m wrong (I’m only a Brit) but it was my understanding that the drive to dole out loans to the less economically viable in terms of home loans or mortgages was an event that had its origins and impetus in the years of the Carter mal-administration in ’77 to ’81. The banks, generally, connived and saw an opportunity to increase their asset base and revenue stream, and enthusiastically supported the policy. When the loans started to fail and the revenue stream from the payback instalments reduced through the ‘90s and 2000s the banks then mixed and matched and then sliced up the debt and sold it on to other dupes, who thought that here was an opportunity for them to get onto another gravy train. When the defaults started to rise that was what precipitated the 2008 meltdown.

Can you elucidate on this view?